To see the actual document sent to our clients please click on the thumbnail link. The list of results will continue to be updated with more results.

Another Successful Short Sale.

Over $100,000.00 Waved by the Bank!

The bank agrees to take

$100,000 less than the amount due

as full and final satisfaction.

Loan Provider: GMAC

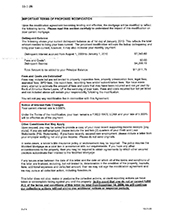

Interest Rate Modified from

6.5% to 3.0%!

Interest rate reduced to a 3.0% ARM.

Max interest rate of 5.0% beginning

in 2016.

$287.00 reduction in monthly payments.

Loan Provider: Aurora Loan Services

Monthly Mortgage Payment

Reduction of $3836.73!

Interest rate reduced from 8.5% ARM

to 3.250% ARM with max rate of 5.01 starting in 2013.

$3836.73 reduction in monthly payments.

Loan Provider: AHMSI, inc.

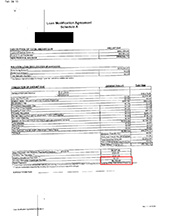

Loan Principle reduction of

$190,481!

5.5% Fixed Rate for

the Life of the Loan!

Principal Reduction of $190,481

Interest rate reduction to 5.5%, fixed.

Term Length: 40 years.

Bank: Bank of America / Countrywide

Interest Rate Reduction to

2.125% ARM!

Interest rate reduced from 6.375%

to 2.125% ARM with max rate of 5.0

starting in 2017.

$298.15 reduction in monthly payments.

Loan Provider: ASC

Interest Rate Reduction to

2.0% ARM!

$815.35 Monthly Payment

Reduction.

Interest rate reduced from 7.550%

to 2.0% ARM with max rate of 5.05%

starting in 2018.

$815.35 reduction in monthly payments.

Loan Provider: Litton Loan Servicing

Interest Rate Reduction to

4.0% ARM!

$1893.12 Monthly Payment

Reduction.

Interest rate reduced from 6.125%

to 4.0% ARM with max rate of 6.125%

starting in 2015.

Loan Provider: Wells Fargo

Monthly Payments Reduced

35%!

Monthly payments reduced $1501.72

from $4,346.85 to $2,845.13

Loan Provider: Bank of America

$1307.06 Monthly Payment

Reduction!

Interest rate reduced from 7.5%

to 2.0% ARM maxing at 5%

in 2017.

Loan Provider: Bank of America

39% Reduction in Monthly

Payments!

Payments reduced from $1,605.74 to $973.26.

Interest rate reduced from 5.75% to

2% ARM.

Loan Provider: GMAC

Interest Rate Reduced to 3.0%

and $655.88 Monthly Payment

Reduction!

Payments reduced from $1,743.06 to $1,087.18.

Interest rate reduced from 5.875% to

3.0% ARM maxing at 5.0% in

November 2011.

Loan Provider: CITI Bank

Exploding ARM Loan Adjusted

to 5.0% Fixed for the Life of the Loan!

5.0% adjustable mortgage modified

to 5.0% fixed for life of the loan with

$70 monthly payment reduction.

Loan Provider: Bank of America

Client Savings of over $254,000!

$687 / Month Decrease in

Mortgage Payment!

Principal Reduction of $139,332

Interest Rate Reduction to 5.5%

Term Length of 40 Years

Bank: Wachovia Mortgage

Client Savings of over $138,710!

$1,267 / Month Decrease in

Mortgage Payment!

Principal Reduction of $71,462

Interest Rate Reduction to 5.0%

Term Length of 40 Years

Bank: Wachovia Mortgage

Client Savings of over $202,682!

$625 / Month Decrease in

Mortgage Payment!

Principal Reduction of $75,577 from second

Interest Rate Reduction to on first 3%

Term Length of 40 Years

Bank: IndyMac/HSBC Bank

$417,481 Debt Forgiven

in Short Sale!

No Liability!

Balance owed on Property of $591,481

Approved short sale amount: $174,000

Debt forgiven by bank: $417,481

Bank: Countrywide Home Mortgage

$94,316 Debt Forgiven

in Short Sale

No Liability

Balance owed on Property of $286,316

Approved short sale amount: $192,000

Debt forgiven by bank: $94,316

Bank: Washington Mutual Bank

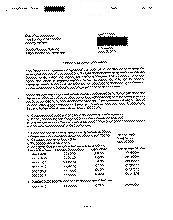

Client Savings of over $574,452!

$1,773 / Month Decrease in

Mortgage Payment!

Original Payment: $3,600

Payment after Loan Modification: $1,827

Term Length of 40 Years

Bank: HSBC Bank USA

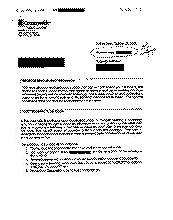

Client Savings of over $304,320!

$634 / Month Decrease in

Mortgage Payment!

Original Payment: $2,529

Payment after Loan Modification: $1,895

Interest Rate Reduction to 4.75%

Term Length of 40 Years

Bank: E*trade Financial

Client Savings of over $119,160!

$1,655 / Month Decrease in

Mortgage Payment!

Original Payment: $3,650

Payment after Loan Modification: $1,995

Interest Rate Reduction to 4.75%

Term Length of 40 Years

Bank: Downey Savings

$100,562 Debt Forgiven

in Short Sale

No Liability

Balance owed on Property of $492,001

Approved short sale amount: $391,439

Debt forgiven by bank: $100,562

Bank: OCWEN Loan Servicing LLC

We hold our clients privacy in the highest of confidence, in order to ensure their attorney/client confidentiality all clients names and property/mortgage inferences have been blacked out.

The results shown are not indicative of a result that you may receive as all cases and clients financial situations are different. We do not guarantee any results or that you will get a short sale approved, or principal reduction, etc. We no longer assist homeowners in contacting their lender for a loan modification. Be careful of any company or lawyer that gives you a guarantee as they are impossible to give as ultimately the final decision rests with the lender.